The Economic Reform Programme (ERP) 2021-2023 was discussed by representatives of the EU Member States, the Western Balkans and Turkey, the European Commission and the European Central Bank, as well as representatives of the central banks of the Western Balkans and Turkey at their annual economic policy dialogue meeting. The meeting was organised under the Slovenian Presidency of the Council of the European Union.

The meeting concentrated on the outstanding challenges in the public health, economic and social areas that the outbreak of the Covid-19 pandemic brought about in the Western Balkans, Turkey and the EU Member States. Participants acknowledged the unwavering solidarity between the EU and the Wester Balkans and Turkey by providing timely medical and financial assistance to fight the COVID-19 pandemic and contributing to address its socio-economic impact in the region. The parties agreed that this year’s economic policy dialogue will focus on supporting the medium-term economic recovery and sustainability of the region, while continuing to temporarily mitigate the impact of the pandemic on growth, employment and social cohesion through transparent fiscal and financial measures. The EU will continue to support the enlargement partners in meeting the economic accession criteria in line with the revised EU Enlargement Methodology. As regards Kosovo’s economic situation in 2020, economic growth turned into a significant recession due to the pandemic-related lockdown and travel restrictions. At the same time, major structural obstacles to growth and competitiveness remain a challenge.

This year’s meeting reviewed the Kosovo Economic Reform Programme, focusing on the effective implementation of structural reforms that will contribute to mitigate the impact of the pandemic and accelerate the post-crisis economic recovery, meanwhile underpinning sustainable macroeconomic and fiscal policy, and gradually restoring fiscal rules is key. In terms of boosting competitiveness and long-term and inclusive growth, Kosovo in particular should tackle the formalisation of the economy and low competitiveness of the private sector; tap in renewable and energy saving potentials and fully opening the energy market; and improve the quality and relevance of the education system to increase employment and mitigate skills mismatches.

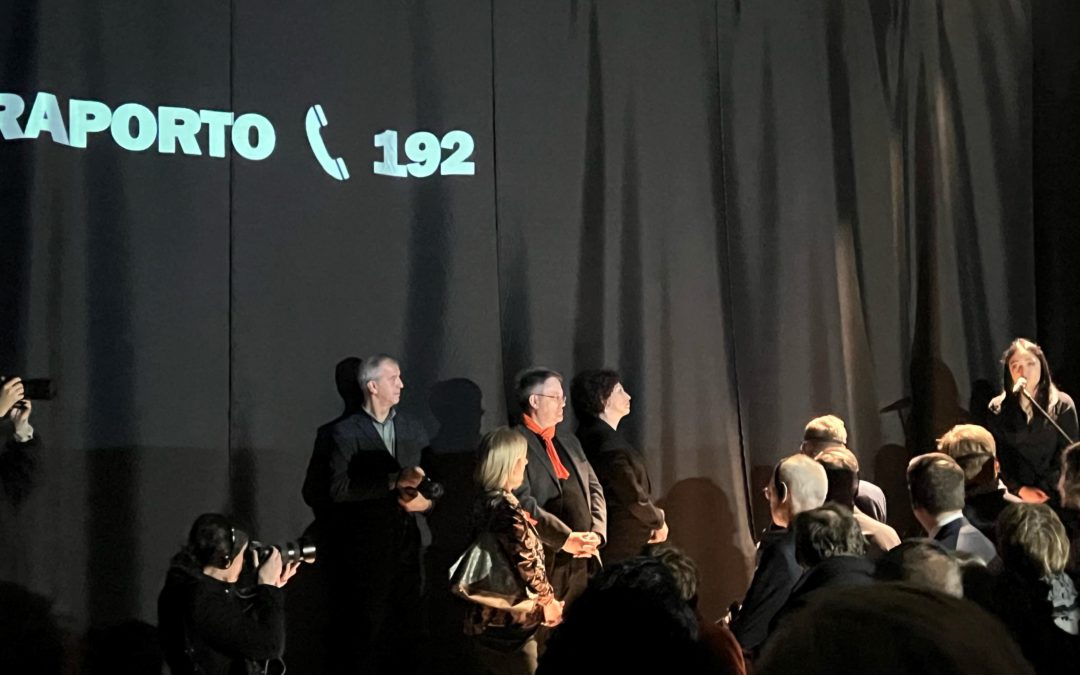

Tomáš Szunyog, Head of EU Office in Kosovo/EU Special Representative, said:

“During the pandemic the EU has demonstrated its support to Kosovo by providing the much needed medical and financial support to fight the pandemic crisis and addressing its socio-economic impact. Structural reform and an agreed policy guidance is now necessary, in order to narrow the socio-economic gap between Kosovo and the EU.”

Hekuran Murati, Kosovo’s Minister of Finance, Labour and Transfers and Economic Reform Programme Coordinator welcomed the approval of the Joint Conclusions on Economic and Financial Dialogue and said: “The Government approved the Budget Review for 2021, according to which the nominal growth rate was revised upwards to 7.9%, and the budget revenue was revised upwards by around 150 million Euros. In the Budget Review for 2021, an Economic Revival Package in the amount of 420 million Euros (around 6% of GDP) is envisaged. The overarching aim of the package is economic revival and the improvement of the social welfare.”

The Economic Reform Programme is a dialogue on economic governance between the EU and the Western Balkans and Turkey. The ERP is meant to prepare the region for future participation in the EU economic policy coordination system known as the European Semester.

This year, six specific targeted reform measures were agreed upon:

- Provide well-targeted and temporary pandemic-related fiscal support to vulnerable households and businesses; provided the economic recovery is well entrenched, foresee in the 2022 budget and medium-term expenditure framework a gradual return to the 2% deficit ceiling, according to the fiscal rule definition, by 2023. With a view to ensuring efficient, fair and sustainable public spending, revise the law on public salaries and prepare a review of the social security system, including war veteran pensions. Undertake a review of tax expenditure quantifying the size of the revenue forgone from exemptions and reduced rates.

- Improve the execution of capital spending by implementing the administrative instructions on the planning, selection, execution and monitoring of capital projects and advancing multi-annual project planning. To reduce the risk of contingent liabilities, improve the financial oversight and accountability of publicly owned enterprises, including their regular quarterly reporting. Take next steps towards establishing an independent body for fiscal oversight, based on the recommendations of an options paper.

- Maintain a strong financial sector regulatory framework in line with international best and EU practices, ensure sound credit risk management, a transparent display of asset quality, adequate provisioning, and develop a more integrated framework for measuring household indebtedness. Further reduce the remaining institutional and legal obstacles to swift and effective NPL resolution. Ensure the central bank’s effective functioning by undertaking an in-depth analysis of the staffing requirements in its key policy areas, especially financial stability and financial sector supervision and filling the vacant positions in the board needed to restore its quorum.

- Adopt a coherent long-term energy and climate strategy for lowering carbon emissions, including plans for a phase-out of coal and fossil fuels subsidies as committed under the Sofia Declaration. In line with the commitments of the Green Agenda for the Western Balkans: increase energy efficiency incentives for the private sector and households and improve the support schemes for renewable energy projects with the introduction of competitive bidding/auctions; adopt an action plan for the gradual adjustment of energy tariffs reflecting actual costs and providing mitigation measures for vulnerable consumers.

- Update the action plan of the 2019–2023 National Strategy for the Prevention and Combating of Informal Economy, Money Laundering, Terrorist Financing and Financial Crimes, and ensure its implementation. Implement incentive measures with an aim to formalise informal employment and businesses, and address tax evasion in identified high-risk sectors in line with the strategy and the action plan. With an aim to prevent evasion of property income tax, improve transparency by publishing all sales prices of real estate property.

- Thoroughly apply existing quality assurance mechanisms at all levels of education through increased school inspections and effectiveness of quality coordinators, as well as monitoring of study programmes by the Accreditation Agency. Develop a system to monitor and forecast the skills needs in the labour market to facilitate the alignment of the education and training systems and of reskilling and upskilling provision to labour market needs. Establish an inter-ministerial task force involving relevant ministries, their agencies and stakeholders to develop a Youth Guarantee Implementation Plan.